0. Foreword

In financial markets, the behavior of individual traders is often driven by emotion, leading to decision bias and long-term losses. As a quantitative analyst formerly with a top-tier tech firm, my core thesis is this: The market is not unpredictable; rather, most people lack a de-emotionalized data processing framework.

This article details an operational method I call the “Adaptive Copy-Trading Strategy.” This is not subjective investment advice based on “gut feeling.” It is a protocol that transforms external signal sources (Master Traders) into low-risk, controllable yield streams through rigorous parameter configuration.

This guide will systematically deconstruct the core principles, implementation steps, critical configurations, and potential challenges of the protocol, aimed at helping you build an automated, emotion-free liquidity management system.

I. Core Principle: Signal Separation & Risk Reconstruction

Individual traders play the role of “Signal Sources” in the market. Their buying and selling behaviors contain raw market insights. However, these signals are often bundled with irrational position management and emotional stop-loss (or lack thereof) behaviors.

The core of my strategy lies in: Separating the raw trading signal from the trader’s risk profile.

Specifically, we extract only the trader’s “Direction” (Long or Short), while completely reconstructing their “Position Size,” “Stop-Loss/Take-Profit Settings,” and “Leverage Multipliers.” This means that even if the signal source adopts high-risk operations, our system can perform Risk Attenuation through preset parameters.

By employing “Signal Separation and Risk Reconstruction,” we achieve:

- Trend Capture: Leveraging the professional judgment of the signal source.

- Extreme Risk Avoidance: Through independently set risk parameters.

- Strategy Resilience: Ensuring our account remains protected even if the signal source makes catastrophic errors.

II. Implementation: Platform Selection & Account Setup

To effectively implement the “Adaptive Copy-Trading Strategy,” standard “One-Click Copy” tools found on most apps are insufficient. We require a trading platform that offers “Granular Parameter Control.”

2.1 Platform Selection Criteria

Based on two years of real-time testing and data analysis, here are the critical filters for selecting a platform:

- Advanced Configuration Module: The platform must allow independent settings for fixed amounts per trade, stop-loss ratios, and margin modes, rather than forcing you to mirror the Master Trader blindly.

- Low-Latency API: Ensuring instructions are executed with minimal delay to avoid yield loss due to Slippage.

- Security & Transparency: The platform must have robust fund custody mechanisms and provide exhaustive historical data for forensic analysis.

Based on these standards, I currently use [Bitget] as my core operational platform. Its technical architecture and flexibility best support this strategy. The following guide is demonstrated using Bitget.

2.2 Account Initialization & Feature Unlocking

To ensure your account can access all necessary functions and receive optimal transaction costs, follow these guidelines:

-

Action: Click here to register your Bitget Professional Account

-

Explanation: This exclusive link automatically matches your account with special fee discounts, lowering your operational costs. Furthermore, registering through this channel ensures your account is tagged to unlock all advanced parameter permissions, avoiding restrictions common to standard new user accounts.

-

Note: Some advanced features may require completing KYC (Identity Verification), particularly for higher withdrawal limits.

III. Sourcing: Quantitative Metrics & Periodic Assessment

Critical Step: After logging in, navigate to “Futures” Copy Trading in the top navigation bar. click here to the page Do not waste time in the Spot area; it lacks the leverage efficiency and advanced risk parameters we require.

The quality of the signal source determines the ceiling of the strategy. We use the “Emilia Dual-Filter Method” to strip away subjectivity and select objectively.

3.1 Phase 1: The Filter (Hard Metrics)

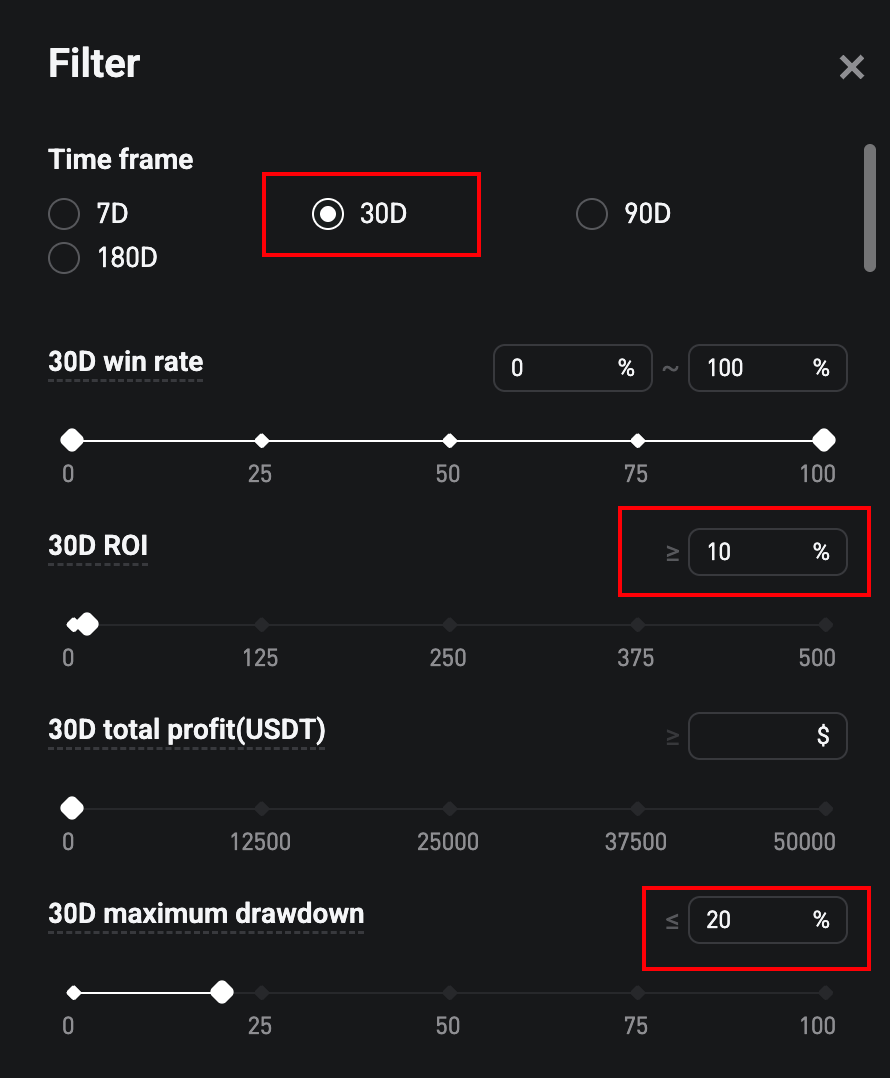

Click the “Filter” button (funnel icon) at the top right of the list and set the following hard metrics using the sliders:

-

Time Frame: Must be 30D

Logic: 7-day data is too luck-dependent; 90-day data is too slow. 30 days is the optimal cycle for measuring recent state.

-

30D ROI (Return on Investment): ≥ 10%

Logic: We don’t need 1000% myths (which usually imply gambling). We need a positive mathematical expectation.

-

30D Maximum Drawdown (MDD): ≤ 20% (The Core)

Logic: This is the line between life and death. If MDD exceeds 20%, the trader is engaging in high-risk gambling (like bag-holding). Filter them out immediately.

-

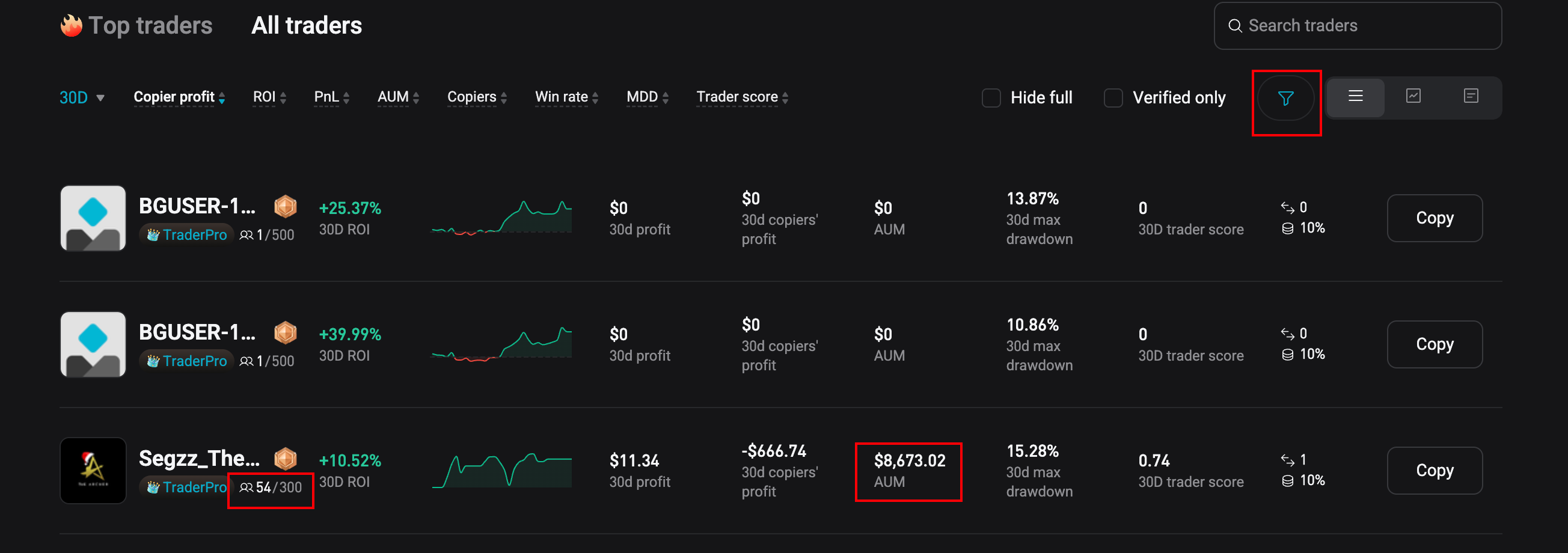

AUM (Assets Under Management): ≥ 5,000 USDT

Logic: Money votes with its feet. There must be a sufficient capital pool following the trader to prove the strategy’s liquidity bearing capacity.

3.2 Phase 2: The Forensic Audit

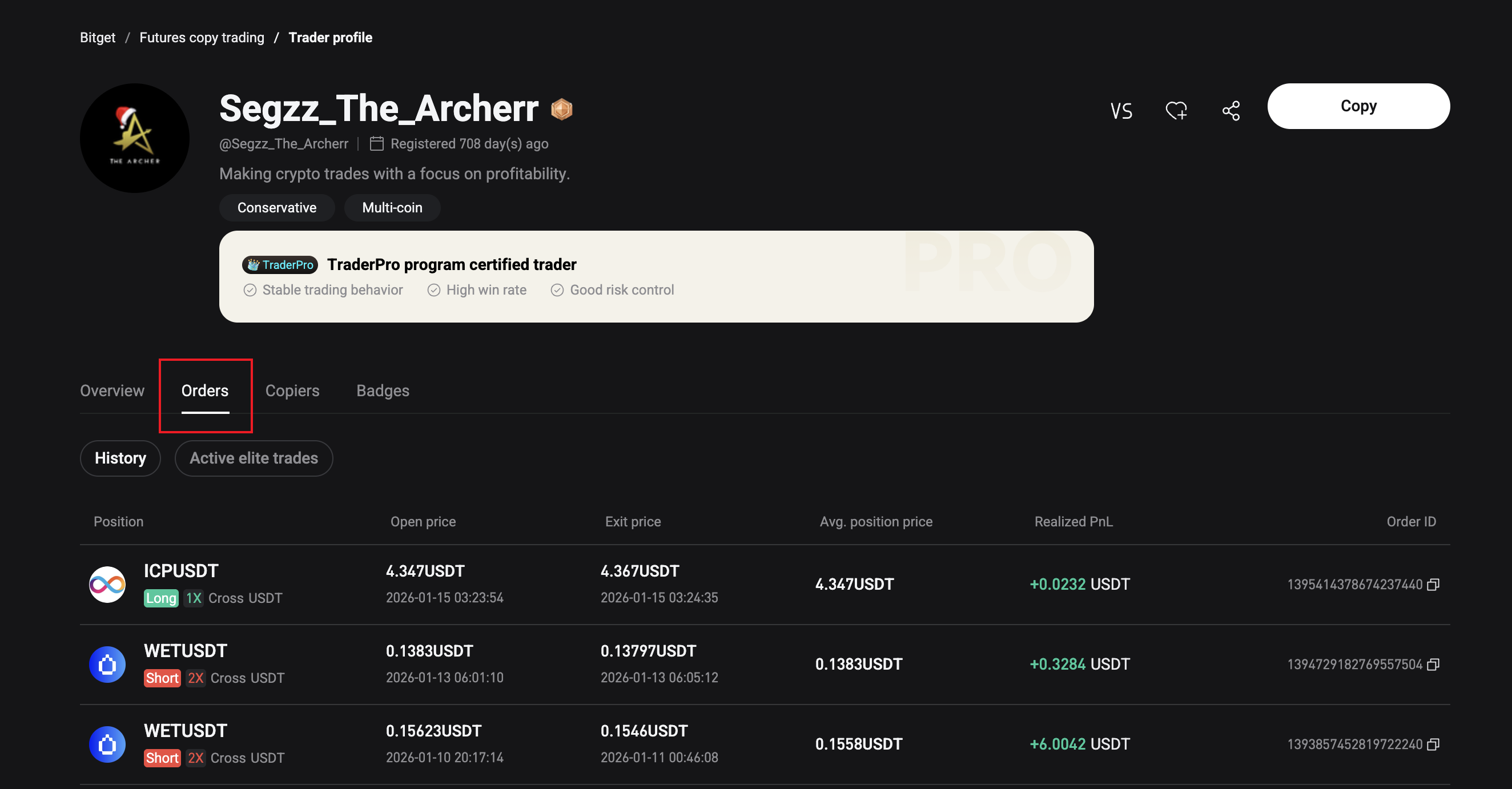

After filtering, click on a trader’s avatar to enter their profile. Since some UIs hide real-time risk data, we must click on “Elite trades” (History) to perform reverse reconnaissance:

- Check “Historical Positions”: If you see a history of green winning trades, but suddenly interspersed with several massive unrealized losses (e.g., holding positions at -50% or -100% for days), this indicates “Martingale/Bag Holding” behavior.

- Emilia’s Warning: These traders often display a 100% Win Rate, but it is a trap. Pass immediately if you see signs of bag holding.

3.3 Periodic Assessment: The “Smoothing Prediction” Mechanism

The validity of a signal source decays over time. Based on the principle of “Smoothing Prediction,” data from the past 30 days can only effectively map performance for the next 7 days. Therefore, we must execute the “7-Day Survival Rule”:

- Theory: We use past low-drawdown data to “lease” a 7-day safety period.

- Action: Perform a “Window Reset” every Friday.

- Decision: Compare the actual results of the last 7 days with the 30-day average. If the drawdown suddenly exceeds the historical average (i.e., the smoothing curve is broken), the strategy is failing or drifting. Stop following immediately.

IV. Deployment: Parameter Configuration (The Core)

This is the phase where theory turns into practice. Since Futures involve leverage, failing to set these parameters exposes your account to unlimited risk.

4.1 Capital Injection & Transfer

- Action: Complete registration and deposit USDT.

- Transfer: Deposits default to the “Spot Account.” You must click “Transfer” to move funds to the Futures Account (USDT-M Futures) to begin.

- Suggestion: For initial testing, $100 - $200 is recommended. Treat this capital as “tuition fee,” not “investment.”

4.2 Core Configuration (Bitget Futures)

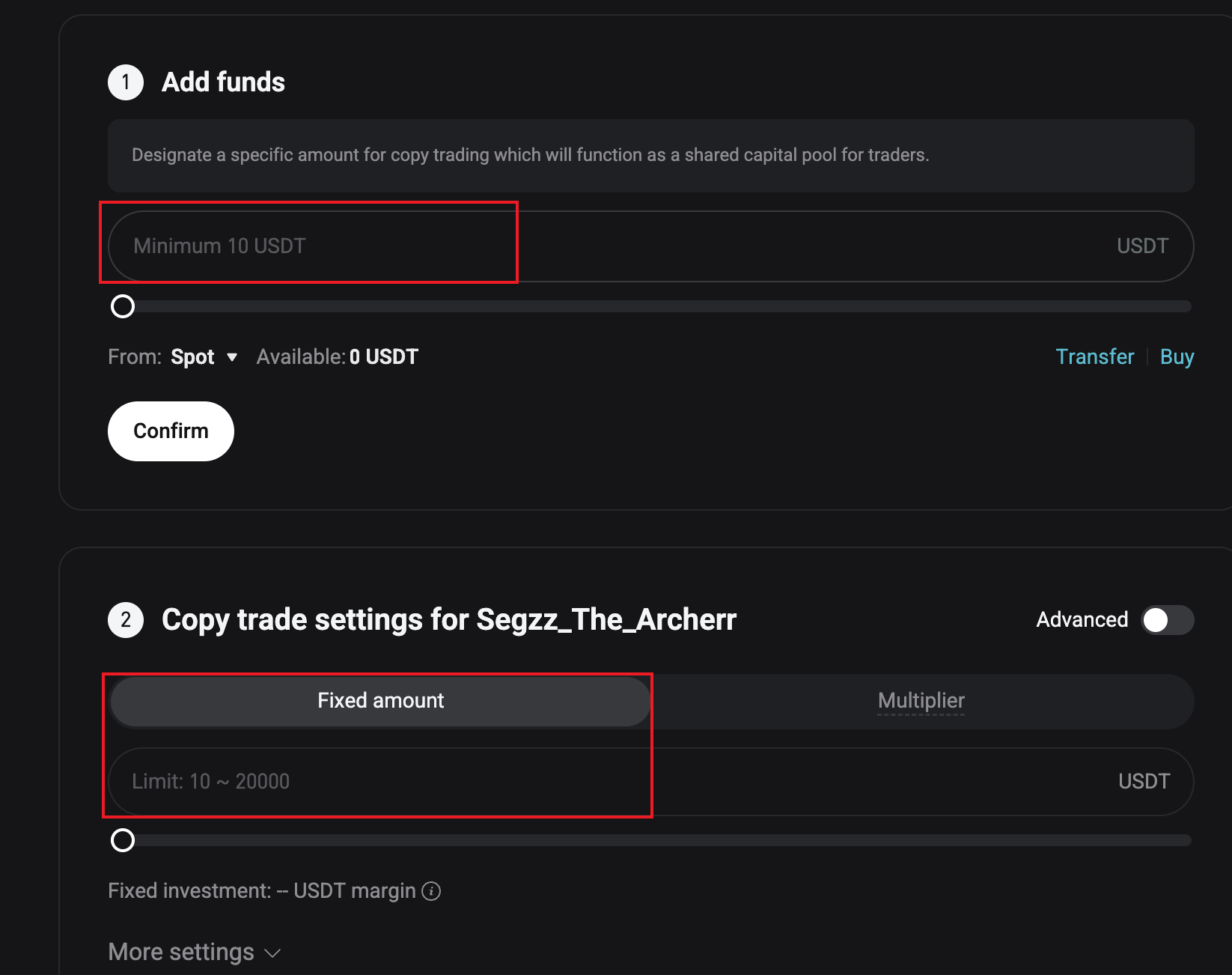

Select a trader and click “Copy”. You will see a popup or configuration page.

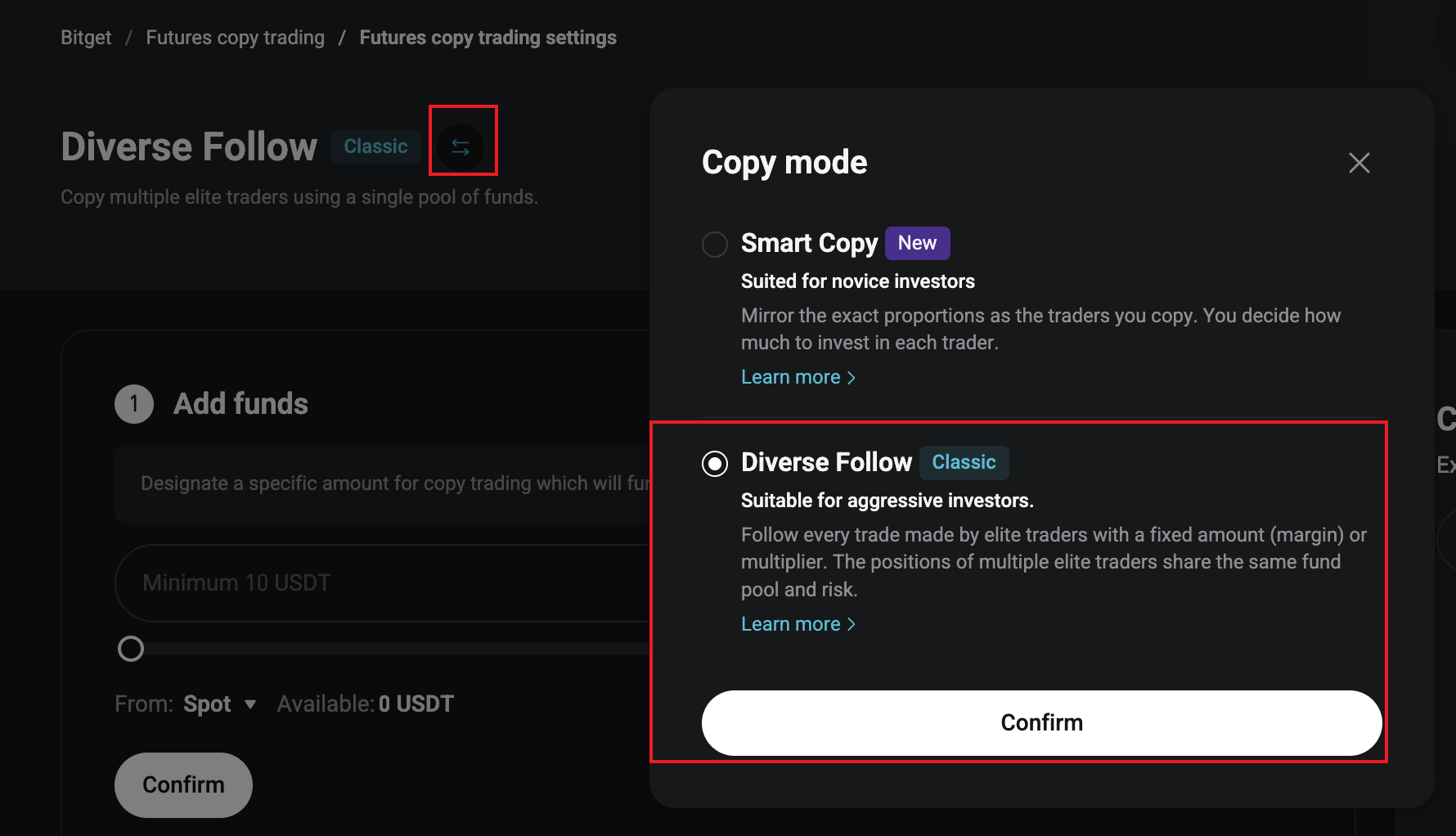

Step 1: Mode Selection - Reject “Smart,” Embrace “Classic”

You will likely see two options:

-

Smart Copy (New): Labeled “Suited for novice investors.” Do NOT select this. It copies the trader’s position ratio. If you have small capital, you risk order failure due to precision issues; if large, you risk full-仓 exposure.

-

Diverse Follow (Classic): Labeled “Suitable for aggressive investors.” Select This.

Emilia’s Note: Only in this mode can we enable the Fixed Amount strategy. We are not being aggressive; we are being precise.

Action: Check Diverse Follow and click Confirm.

Step 2: Capital Allocation - The Firewall

You will see a field for “Equity of elite trader”.

- Setting: Input the total maximum capital you are willing to allocate to this specific trader.

- Suggestion: 50 USDT - 100 USDT for testing.

- Logic: Even if all risk controls fail, you only lose this specific allocation, not your entire wallet.

Step 3: Fixed Amount Per Trade

- Setting: $10 - $30.

- Principle: This is the core of “Fixed Unit Investment.” Never use “Multiplier Mode.” Under Fixed Amount mode, whether the Master Trader goes “All-In” or opens 100x leverage, your system only invests your fixed $10. This maximizes risk isolation.

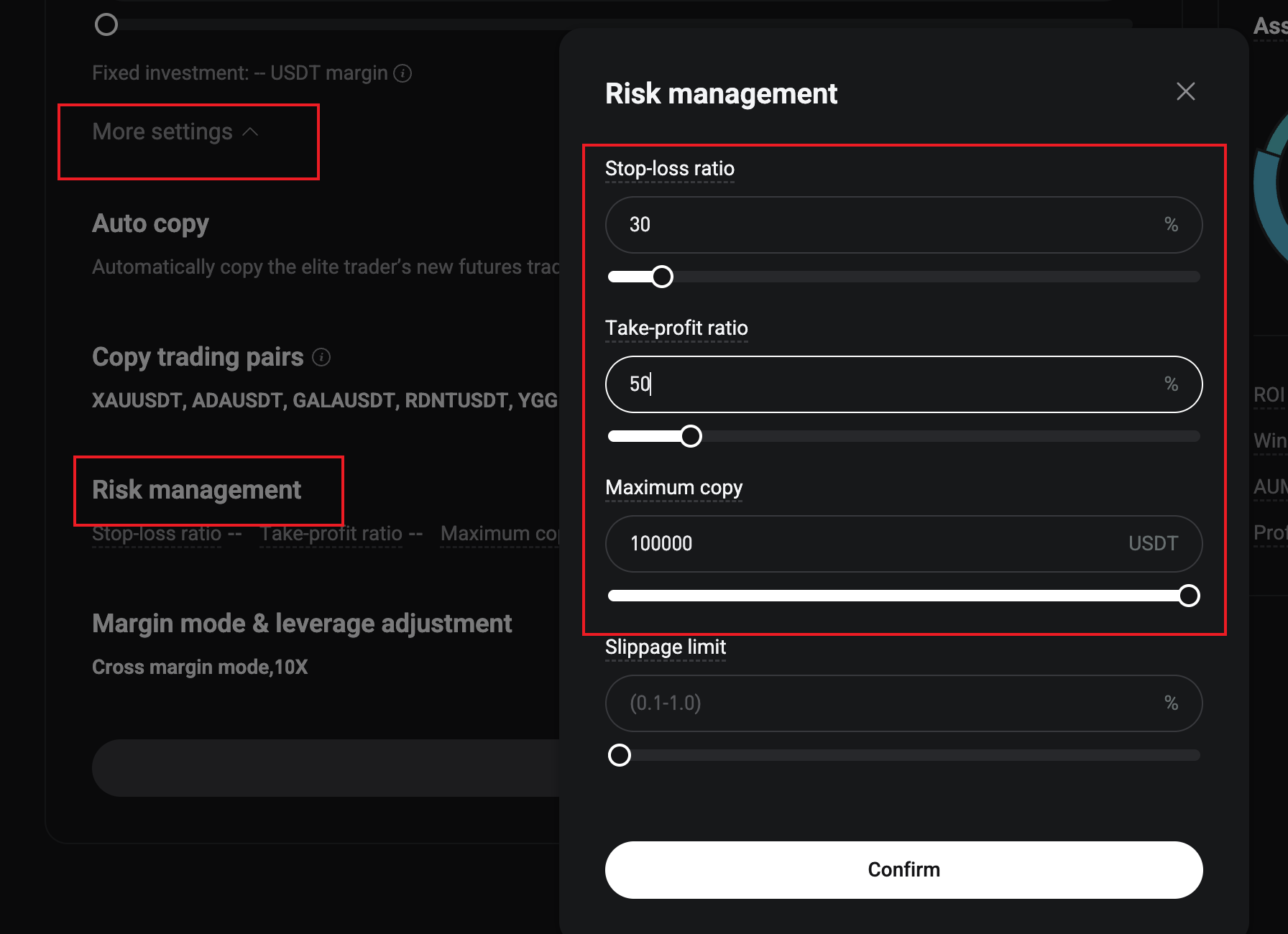

Step 4: Core Risk Control - Risk Management

Scroll to the bottom, find “Risk Management”, and click Edit >.

- Stop-loss ratio: Input 30%.

- Principle: This is your circuit breaker. If a single trade loses 30% (e.g., $3 loss on a $10 trade), the system forcibly closes the position. You take a scratch; the gambler takes a bullet.

- Take-profit ratio: Leave blank or set to 50%.

- Maximum copy: Set to 50,000 (to prevent missing trades due to upper limits).

- Action: Click Confirm.

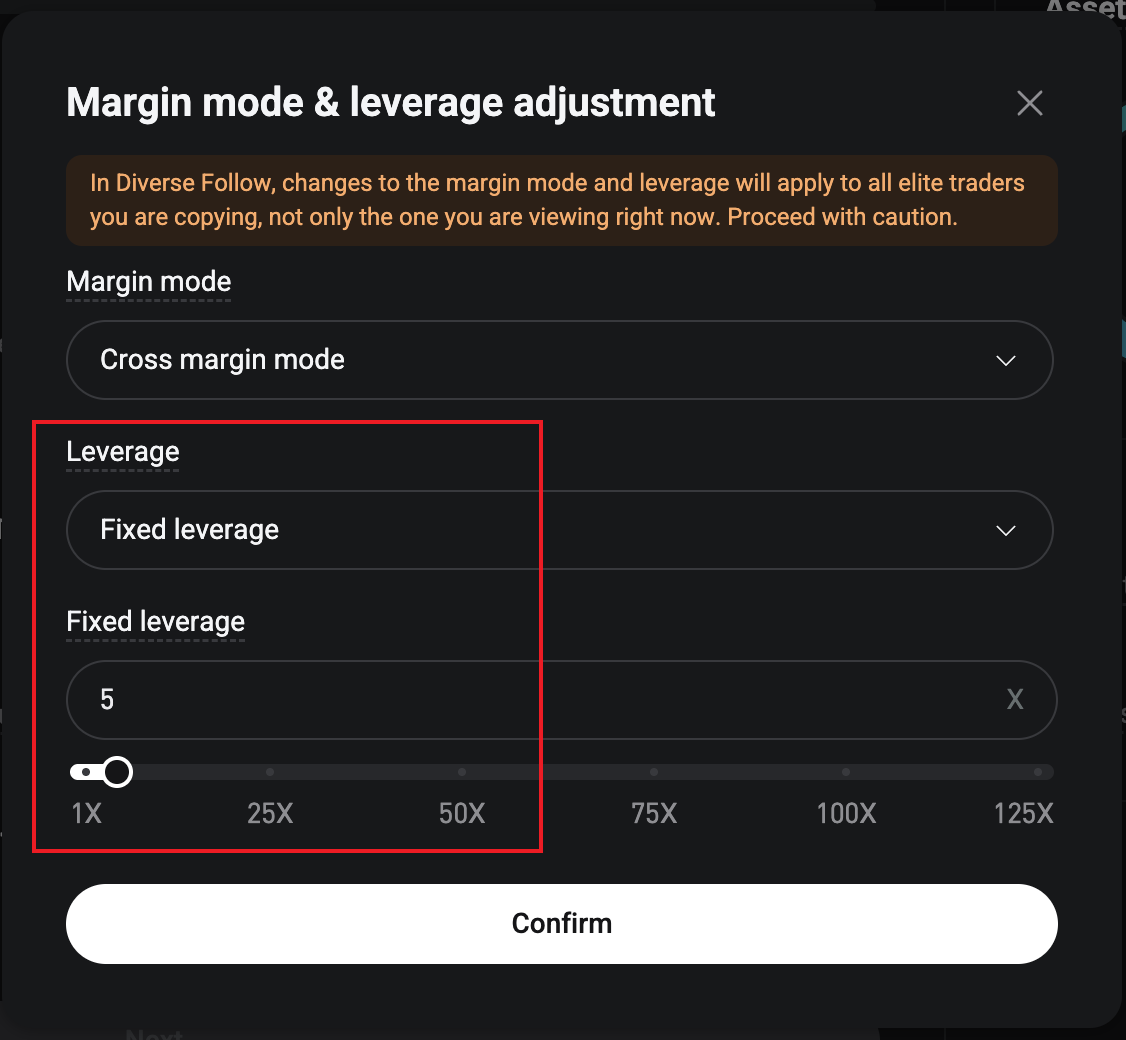

Step 5: Leverage Cap - Copy Trading Pairs

Find “Copy trading pairs” in the middle and click Edit >.

- Action: Select All. Go to Settings.

- Leverage Mode: Manually set all pairs to Fixed 5x.

- Principle: Limit the leverage physically. Even if the trader uses 100x, your account remains at 5x.

4.3 Activation

- Review: Verify: Mode is Diverse Follow. Stop-loss is 30%. Leverage is capped.

- Action: Click “Next” then “Confirm”.

- Post-Activation: The system runs automatically. Do not interfere manually.

V. Scaling & Advanced Management

Once your Adaptive Strategy is stable and verified, consider the following for scaling.

5.1 Fund Layering & Multi-Account Deployment

- Logic: Avoid “Single Point of Failure.” Distribute total capital across 2-3 different accounts or sub-accounts.

- Advantage: Mitigates technical risks (e.g., server downtime) and allows following diverse signal sources simultaneously.

5.2 Portfolio Construction

- Practice: Don’t rely on one signal. Based on weekly screening, I typically build a portfolio of 2-3 “Stable” sources + 1 “Growth” source.

- Goal: Stable sources provide base yield and hedge volatility; the Growth source captures alpha.

VI. Challenges & Countermeasures

Even the most rigorous strategy requires optimization.

-

Signal Decay: Every trader’s performance degrades over time.

Countermeasure: Strictly follow the weekly assessment. Stop following immediately if metrics slip.

-

Platform Updates: Exchange features evolve.

Countermeasure: Regularly check platform update logs to ensure your configuration remains compatible.

-

Emotional Temptation: You may be tempted to manually intervene during short-term volatility.

Countermeasure: Trust the model and the data. Do not interfere with a running strategy, especially when facing short-term drawdown.

Conclusion

The financial market is not an exclusive game for the elite; it is an arena of rules and logic. By stripping away emotion, embracing data, and configuring tools with granular precision, anyone can build their own liquidity management system.

This action guide provides all the core experience I’ve gained in building this system. The next move depends on you.

— Emilia Lubablonde